What happened last week?

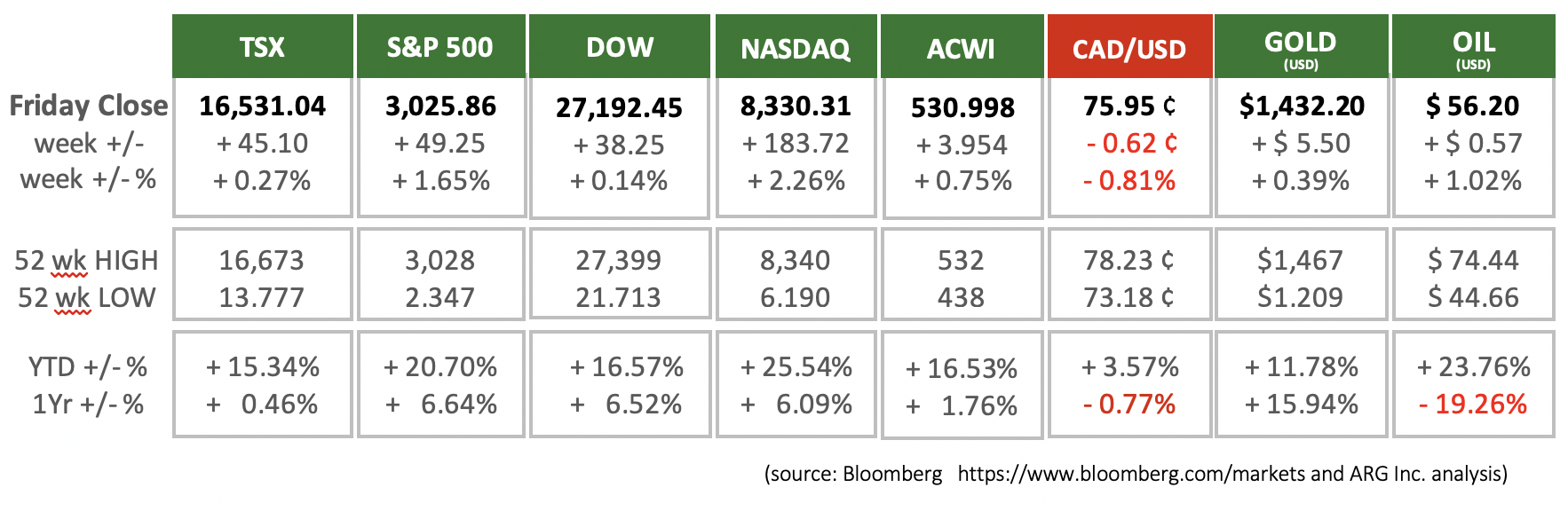

With our dollar as the lone exception, it was an all-green week. Since most Canadian investors have their sharpest focus on the performance on equities, last week did not disappoint, unless you were also only focused on Canadian stocks.

Renewed efforts to end the U.S./China trade disputes have provided optimism that economic activity between the two nations would resume its former healthy levels.

The corporate earnings season, particularly in the U.S., has proved to be better-than-expected. Nearly half the firms in the S&P 500 have reported, and 77% of them have beat profit expectations, and their stock prices reflect this performance. Google led the way with a 10% price increase after their earnings announcement. https://www.barrons.com/articles/earnings-season-so-far-revenue-beats-meet-low-expectations-51564196201

American GDP results show that their economy was performing better than thought, but not so well to change the anticipated rate cut by the Federal Reserve. A rate cut this week will make borrowing cheaper for all firms, and it is expected to lead to economic expansion, higher profits and, ultimately, greater equity values. https://www.theglobeandmail.com/business/article-us-federal-reserve-interest-rate-cut-over-rising-trade-war-risks/

Last week here at home, the TSX continued its slow, steady upward climb, approximating the results of the Dow, but not nearly as impressive as the S&P 500’s new record high, and the NASDAQ staying very close to its all-time high. The TSX was helped along by the price of oil, and the consumer staples and technology sectors.

What’s ahead for this week?

In Canada, the results of our economic health and growth will be released through May’s Gross Domestic Product (GDP), and June’s international trade, numbers.

In the U.S., the long-awaited Federal Reserve interest rate decision will finally occur on Wednesday at 2 pm Eastern. Also, personal income and spending, construction spending, durable goods orders, trade balance for June, the employment report for July will be released.